Unknown Facts About Feie Calculator

Feie Calculator Fundamentals Explained

Table of ContentsAll About Feie CalculatorNot known Details About Feie Calculator The smart Trick of Feie Calculator That Nobody is Talking AboutRumored Buzz on Feie CalculatorAll about Feie CalculatorAn Unbiased View of Feie CalculatorWhat Does Feie Calculator Do?

In basic, united state people or irreversible legal locals living abroad are qualified to declare the exemption. The quantity of the exemption is readjusted every year based upon the rate of rising cost of living. The amount of exclusion for present and past tax years is as follows:2015: $100,8002014: $99,2002013: $97,6002012: $95,100 In addition to this earnings exemption, the taxpayer may also certify to exclude the worth of employer-provided dishes, accommodations and specific fringe benefits.To start with, federal government workers are usually ineligible for the international revenue exemption also if they are living and working in a foreign country. A two year-old D (https://www.startus.cc/company/feie-calculator).C. Circuit Court decision, Rogers v. Commissioner, may put the worth of the international income exclusion in risk for thousands of expatriates. Rogers included a U.S

The Best Strategy To Use For Feie Calculator

The same regulation would relate to a person who services a ship in worldwide waters.

The Foreign Earned Revenue Exemption (FEIE) permits qualifying U.S. taxpayers to omit as much as $130,000 of foreign-earned income from U.S. government earnings tax (2025 ). For numerous expatriates and remote employees, FEIEs can suggest substantial cost savings on U.S. tax obligations as foreign-earned earnings might be based on double taxes. FEIE jobs by leaving out foreign-earned earnings as much as a certain restriction.

On the other hand, easy earnings such as interest, rewards, and capital gains do not receive exemption under the FEIE. Certain eligibility tests require to be fulfilled in order for expatriates to qualify for the FEIE arrangement. There are two main tests to determine qualification for the FEIE: the Physical Visibility Test and the Authentic Home Test.

A Biased View of Feie Calculator

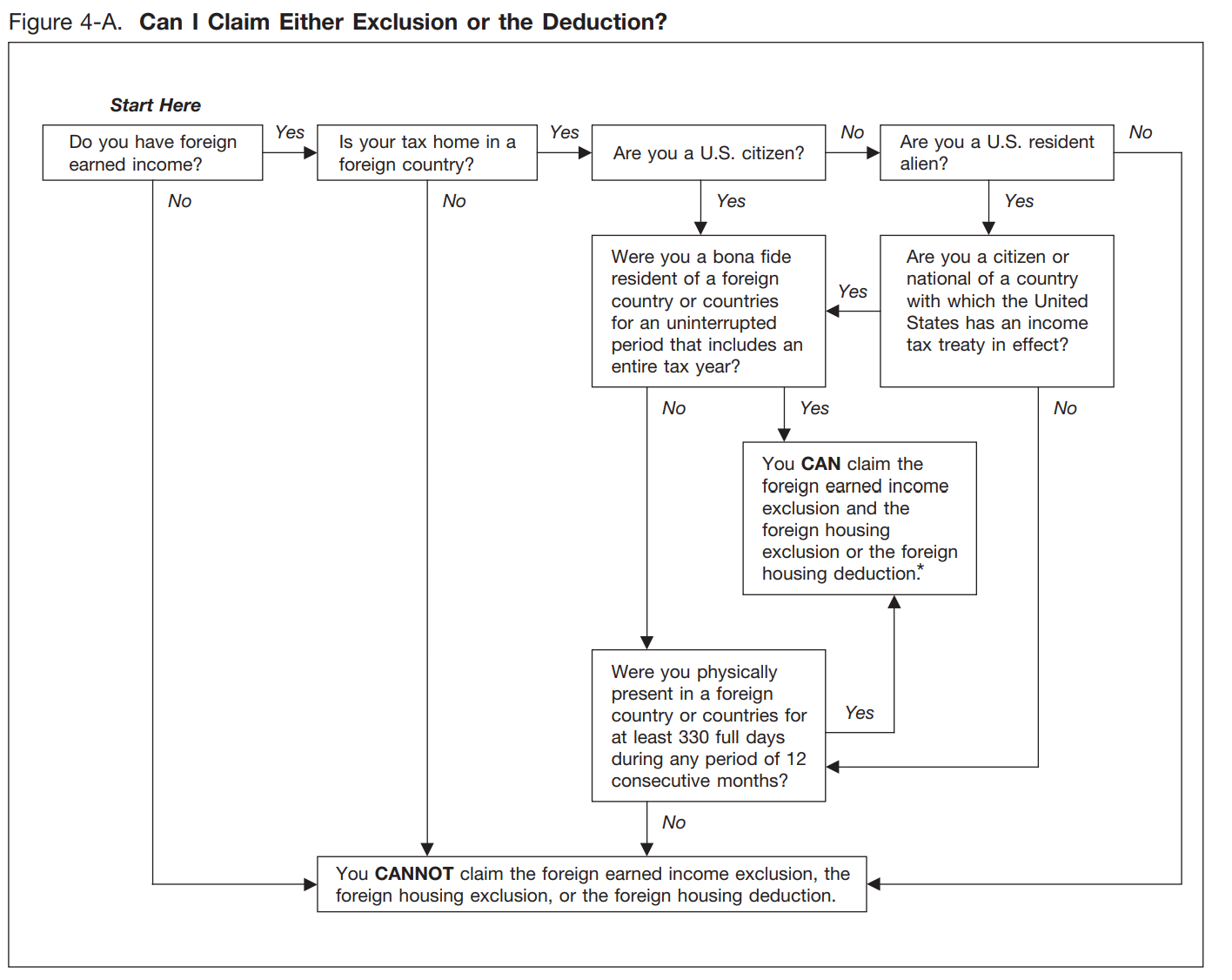

The United state taxpayer should have foreign-earned income. This United state taxpayer should have a tax obligation home in a foreign nation (with a tax obligation home defined as the area where a person is engaged in job).

It's recommended that individuals use traveling trackers or applications that enable them to log their days invested in different locations, guaranteeing that they meet the 330-day need. The U.S. taxpayer must have a tax obligation home in a foreign country.

taxpayer has to have been an authentic citizen of an international country for a minimum of one tax obligation year. "Authentic citizen" standing calls for demonstrating irreversible international living with no unavoidable return to the united state Trick signs of this standing may consist of long-term real estate (whether leased or possessed), regional bank accounts, or getting a residency visa.

The smart Trick of Feie Calculator That Nobody is Discussing

For couples, both partners will certainly require to fill out a separate Type 2555, also if they're submitting taxes jointly. To complete a 2555 type, you'll require to: Select between the Bona Fide Home Examination and the Physical Presence Test Record all worldwide traveling to and from the US during the tax obligation year.

Mark computes the currency exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his income (54,000 1.10 = $59,400). Since he lived in Germany all year, the portion of time he lived abroad during the tax is 100% and he gets in $59,400 as his FEIE. Finally, Mark reports complete earnings on his Type 1040 and gets in the FEIE as an adverse quantity on Schedule 1, Line 8d, minimizing his gross income.

The Best Strategy To Use For Feie Calculator

Choosing the FEIE when it's not the most effective choice: The FEIE may not be optimal if you have a high unearned income, gain greater than the exemption limit, or reside in a high-tax nation where the Foreign Tax Obligation Credit Report (FTC) might be extra valuable (Form 2555). The Foreign Tax Obligation Credit (FTC) is a tax reduction technique typically made use of along with the FEIE

expats to offset their united state tax financial debt with foreign earnings tax obligations paid on a dollar-for-dollar decrease basis. This indicates that in high-tax nations, the FTC can typically remove united state tax financial obligation totally. The FTC has limitations on eligible tax obligations and the optimum case amount: Eligible taxes: Only earnings taxes (or taxes in lieu of income tax obligations) paid to foreign governments are eligible.

tax obligation on your foreign income. If the international tax obligations you paid surpass this limitation, the excess foreign tax obligation can generally be continued for up to 10 years or lugged back one year (by means of a modified return). Keeping exact documents of international income and taxes paid is for that reason vital to calculating the correct FTC and keeping tax obligation conformity.

Not known Factual Statements About Feie Calculator

expatriates to reduce their tax responsibilities. If an U.S. taxpayer has $250,000 in foreign-earned revenue, they can omit up to $130,000 utilizing the FEIE (2025 ). The staying $120,000 might then go through taxation, however the U.S. taxpayer can possibly use the Foreign Tax Credit score to offset the tax obligations paid to the foreign nation.

If he 'd regularly taken a trip, he would instead complete Component III, noting the 12-month period he satisfied the Physical Visibility Test and his traveling history. Step 3: Reporting Foreign Revenue (Part IV): Mark earned 4,500 monthly (54,000 each year). He enters this under "Foreign Earned Income." If his employer-provided real estate, its value is also included.

What Does Feie Calculator Mean?

Choosing the FEIE when it's not the ideal alternative: The FEIE may not be optimal if you have a high unearned income, gain more than the exclusion limit, or live in a high-tax country where the Foreign Tax Obligation Credit Score (FTC) might be much more advantageous. The Foreign Tax Debt (FTC) is a tax reduction approach commonly utilized together with the FEIE.

deportees to offset their U.S. tax financial debt with foreign earnings tax obligations paid on a dollar-for-dollar decrease basis. This means that in high-tax countries, the FTC can typically eliminate U.S. tax obligation financial debt totally. However, the FTC has limitations on eligible tax obligations and the optimum claim quantity: Eligible tax obligations: Only earnings taxes (or tax obligations instead of income tax obligations) paid to foreign governments are eligible.

tax obligation responsibility on your foreign income - https://www.goodreads.com/user/show/192466965-feie-calculator. If the foreign tax obligations you paid exceed this limit, the excess foreign tax can generally be lugged onward for up to ten years or returned one year (using a modified return). Maintaining exact records of international revenue and tax obligations paid is therefore crucial to computing the proper FTC and keeping tax compliance

migrants to decrease click this link their tax obligation obligations. If an U.S. taxpayer has $250,000 in foreign-earned earnings, they can omit up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 may then be subject to tax, but the united state taxpayer can potentially use the Foreign Tax obligation Credit report to counter the tax obligations paid to the international country.